Business Loan Solutions for Filipino Entrepreneurs

Need additional capital to expand your business? GigGenius partners with Security Bank to provide flexible financing options.

Learn More

BUSINESS PLUS Account

Open your BUSINESS PLUS account now and access these financing options:

Other Financial Products:

Auto Loan

1 Day Approval!

Home Loan

Credit Card

Time Deposit

Personal Loan

Key Features

Competitive Advantages

Our business loan solutions offer competitive advantages designed specifically for Filipino entrepreneurs. With no collateral requirements for loans up to ₱7.5M, minimal documentation, and fast approval process.

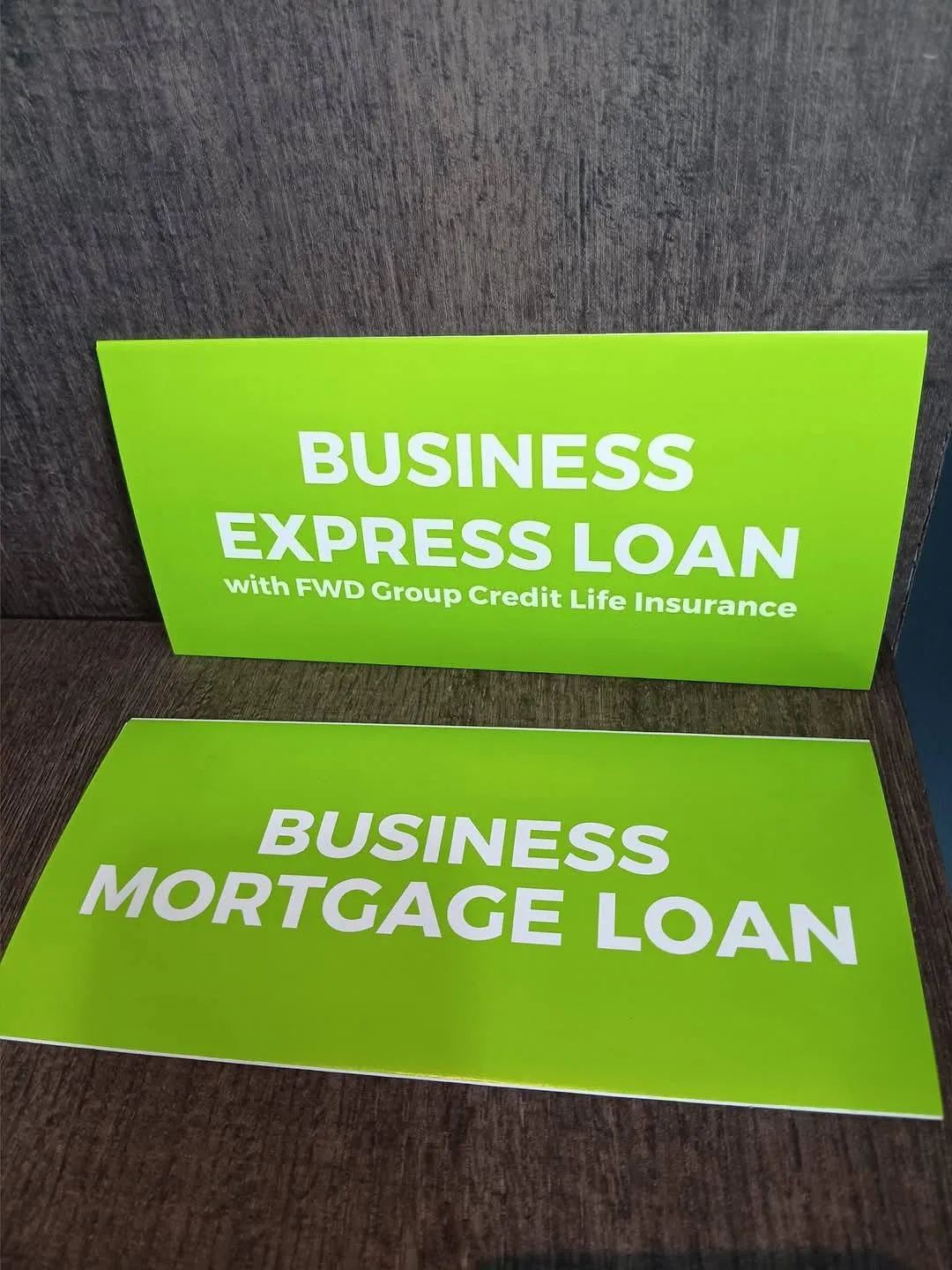

Loan Options

Choose between Business Express Loan with FWD Group Credit Life Insurance or Business Mortgage Loan to suit your specific business financing needs.

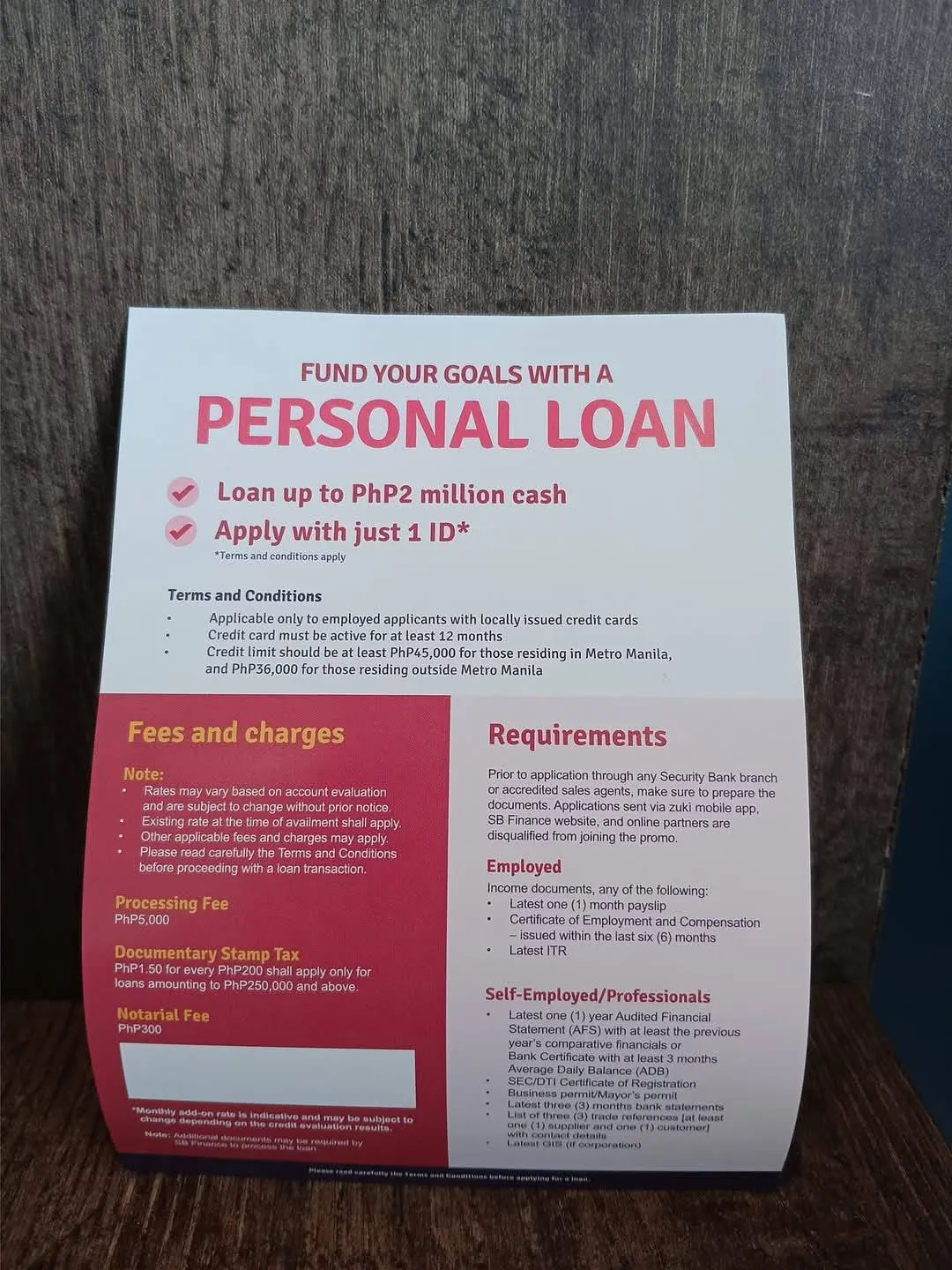

Personal Loan

Fund your personal goals with loans up to ₱2 million cash. Apply with just 1 ID and get approved quickly with minimal requirements for both employed and self-employed individuals.

Requirements

Basic Requirements:

- Duly filled-out and signed BEL application forms

- Valid IDs

-

Business permits:

- If sole proprietorship:

- DTI (latest and old DTI)

- Latest Mayor's permit with OR

- If partnership/corporation:

- SEC Certificate of Incorporation

- Articles of Incorporation

- By-laws

- SEC amendments, if any

- Latest General Information Sheet

- If sole proprietorship:

-

Financial/Income documents:

- Latest 6 months Bank Statements

- Latest 3 years AFS/ITR

- Proof of latest transactions with clients and suppliers (i.e. Contracts, PO, Invoices etc.)

Ready to apply?

Contact our official broker for more details.